AI Infrastructure for Financial Services

Modernize fraud detection, customer service, and risk modeling with secure, scalable AI systems that keep your data in your control.

Overview

AI is transforming every corner of financial services, from client onboarding and claims processing to portfolio management and fraud detection. But many teams are stuck in the prototype stage, unable to move into production due to compliance hurdles, data residency requirements, and brittle infrastructure.

Cake provides a secure, composable platform that makes it easy to build and deploy AI systems in your own environment. Use the open-source tools you trust, keep your sensitive data protected, and move faster with infrastructure designed for finance.

Unlike closed platforms that restrict how and where you can deploy models, Cake gives you full control over your stack. You can integrate LLMs, vector databases, orchestration frameworks, and observability tools in your own cloud. This flexibility lets you build AI systems that align with internal policies, meet strict regulatory standards, and scale without compromising performance or security.

Key benefits

-

Protected sensitive data at every layer: All workloads run inside your environment with no data egress, ensuring financial data stays secure and compliant.

-

Accelerated development with trusted tools: Use best-in-class open-source components and models without building the integrations yourself.

-

Reduced infrastructure risk and overhead: Avoid brittle, ad hoc stacks with a platform that is secure, composable, and built for production workloads.

-

Streamlined compliance and audit readiness: Get fine-grained access controls, detailed logs, and built-in support for regulations like PCI DSS and SOX.

-

Faster deployment across use cases: From fraud detection to advisor support, move from prototype to production quickly with Cake as your foundation.

THE CAKE DIFFERENCE

![]()

Build secure, compliant AI

(without the markup)

The traditional vendor approach

Closed platform, long contract, limited control

- Hosted in the vendor’s cloud with limited portability

- Black-box tooling with few customization paths

- Per-seat or usage-based pricing that grows fast

- Compliance and auditability dictated by vendor policy

Result:

Initial lift, but long-term lock-in and rising costs

The Cake approach

Composable AI infrastructure, built for regulated environments

- Deploy in your own cloud or VPC without vendor lock-in

- Full transparency and control across data, models, and workflows

- PCI- and SOC 2-ready with built-in observability and access control

- Optimize compute usage to save $500K–$1M per project

Result:

Result: Faster time to value, full control, and scalable cost efficiency

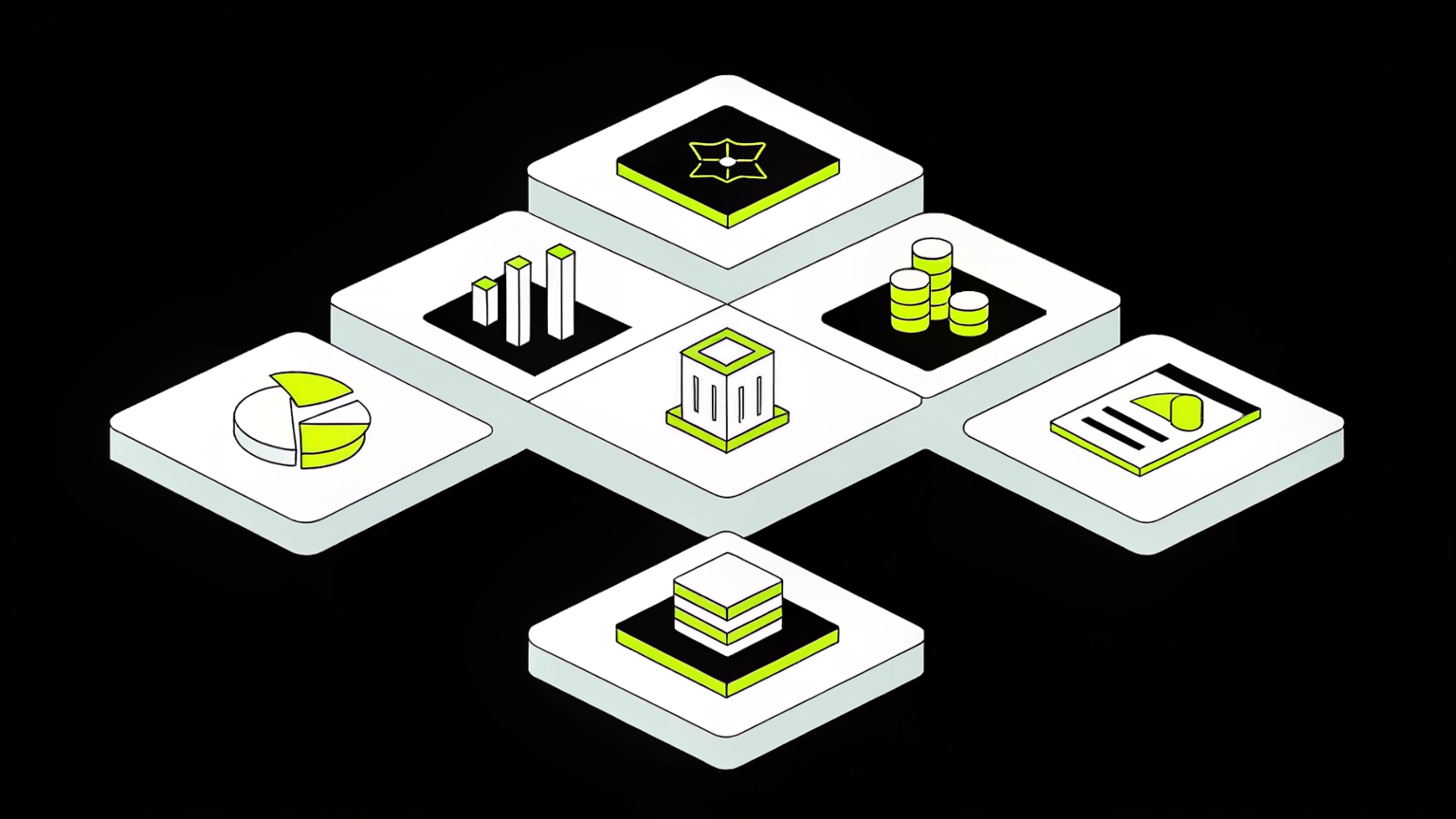

EXAMPLE USE CASES

![]()

Deploy production-ready AI

across your financial workflows

![]()

Fraud detection and anomaly monitoring

Run secure pipelines that identify suspicious activity in real time, with infrastructure that can adapt quickly to new threat vectors and transaction patterns.

![]()

Customer service automation

Deploy compliant voice agents and chatbots that can understand account data, resolve requests faster, and operate securely at scale.

![]()

Credit scoring and risk analysis

Integrate ML models directly into your underwriting processes to improve decision-making and automate evaluations across large portfolios.

![]()

Document classification and extraction

Use AI to parse financial documents such as invoices, loan applications, and regulatory filings with high precision and minimal human input.

![]()

Advisor enablement tools

Give advisors and service reps intelligent copilots that surface client insights, streamline research, and recommend personalized next steps.

![]()

Market research and analysis

Combine retrieval-augmented generation with internal and external financial data to power new insights, generate reports, and enhance decision support.

BLOG

5 transformative use cases for AI in financial services

Explore the top use cases for AI in financial services, from fraud detection to personalized customer experiences, and see how AI is transforming the industry.

DATA SECURITY

Build AI on your terms. Keep full control of your data

With Cake, you can build, deploy, and scale AI solutions in your own environment. No data sharing required. Your training data is your competitive edge; our platform is designed to keep it that way.

From infrastructure to inference, Cake helps you move fast and keep Big Tech's hands off what's yours.

"Our partnership with Cake has been a clear strategic choice – we're achieving the impact of two to three technical hires with the equivalent investment of half an FTE."

Scott Stafford

Chief Enterprise Architect at Ping

"With Cake we are conservatively saving at least half a million dollars purely on headcount."

CEO

InsureTech Company

Frequently asked questions

What is Cake?

Cake is a secure, cloud-agnostic AI platform that helps enterprises build and deploy production-grade AI systems using open-source components. It gives you full control over your infrastructure, data, and toolchain.

How does Cake support compliance in financial services?

Cake runs entirely in your cloud environment, with no data egress and full auditability. It supports compliance with PCI DSS, SOX, GLBA, and other financial regulations through fine-grained access control, federated identity, and detailed observability.

Can we use our own models and databases with Cake?

Yes. Cake is designed to be modular and composable. You can bring your own LLMs, vector databases, orchestration tools, and observability systems—and Cake provides the scaffolding to make them work together reliably.

Is Cake only for large institutions?

Not at all. Cake is designed to scale with your needs. Whether you’re a fintech startup or an established institution, you can start small and grow your AI capabilities over time, without re-architecting your stack.

How does Cake handle data security for financial applications?

Cake never takes custody of your data. All workloads run inside your own cloud or VPC, and built-in policy enforcement, encryption, and access control help you meet the strictest data protection requirements.

Learn more about financial services powered by Cake

Top Open-Source Tools for Financial AI Solutions

Jumping into open-source AI can feel like a big leap, but with the right approach, you can set your team up for success. The key is to be intentional...

Top Use Cases for AI in Financial Services

Today’s customers expect more from their financial institutions. They want instant support, personalized advice, and seamless digital experiences....

Agentic RAG Solutions for Regulated Industries

A standard RAG system is a great research assistant. It finds facts for you, fast. An Agentic RAG system is your senior project manager. Give it a...

.png?width=220&height=168&name=Group%2010%20(1).png)