Building Insurance AI with Cake

Power smarter claims, underwriting, and customer experiences with secure, modular AI infrastructure that's built to meet the demands of modern insurance.

Overview

Insurance operations are complex, highly regulated, and often burdened by legacy systems and manual processes. From claims processing to underwriting to customer service, teams rely on a web of disconnected tools and siloed data. This slows down decision-making, drives up costs, and makes it harder to respond to customer needs or regulatory changes.

Cake helps insurers accelerate transformation by giving teams a secure, compliant AI stack that works with their existing infrastructure. You can ingest structured and unstructured data from policy documents, emails, or third-party systems, then apply best-in-class open-source models to classify, extract, summarize, or route information in real time. Whether you’re building virtual agents, streamlining FNOL intake, or flagging high-risk applications, Cake provides the flexibility to test, iterate, and deploy with confidence.

Every component of Cake is designed for production-grade insurance workloads. Run everything inside your own environment to maintain strict data control. Stay compliant with HIPAA, SOC 2 Type II, and other industry standards without extra configuration. And reduce infrastructure overhead with a modular platform that simplifies orchestration, observability, and scaling so your team can focus on building AI that delivers results across the entire policy lifecycle.

Key benefits

-

Accelerated deployment of AI use cases: Teams used Cake to ship new AI-powered workflows up to 70% faster with reusable, modular components.

-

Improved compliance posture and data control: Run workloads in your own cloud environment and meet HIPAA, SOC 2 Type II, and other regulatory standards with confidence.

-

Lower infrastructure and ops costs: Reduce AI ops overhead by up to $1M/year with managed infrastructure and automatic scaling.

-

Built-in support for open source innovation: Stay at the forefront of AI by adopting best-in-class open source models and tools without vendor lock-in.

-

Easy integration with legacy systems:: Connect AI workloads to existing claims, policy, and CRM systems without needing to rebuild from scratch.

THE CAKE DIFFERENCE

![]()

Modern insurance demands

more than black-box AI

The traditional vendor approach

Black-box models, rising costs, and roadmap risk

- Hosted in the vendor’s cloud with limited explainability

- Difficult to validate models for fairness or regulatory compliance

- Long-term contracts with usage-based pricing

- Updates and roadmap controlled by the vendor

Result:

AI that works—until you need to customize, explain, or scale it

The Cake approach

Composable AI infrastructure for regulated insurance environments

- Deploy explainable models with full visibility and audit trails

- Run in your own cloud or VPC to meet data residency rules

- SOC 2- and HIPAA-ready stack with pre-integrated observability

- Modular architecture enables faster launches and lower TCO

Result:

Faster product launches, lower risk, and total control over data and models

EXAMPLE USE CASES

![]()

Drive transformation across

the insurance lifecycle

![]()

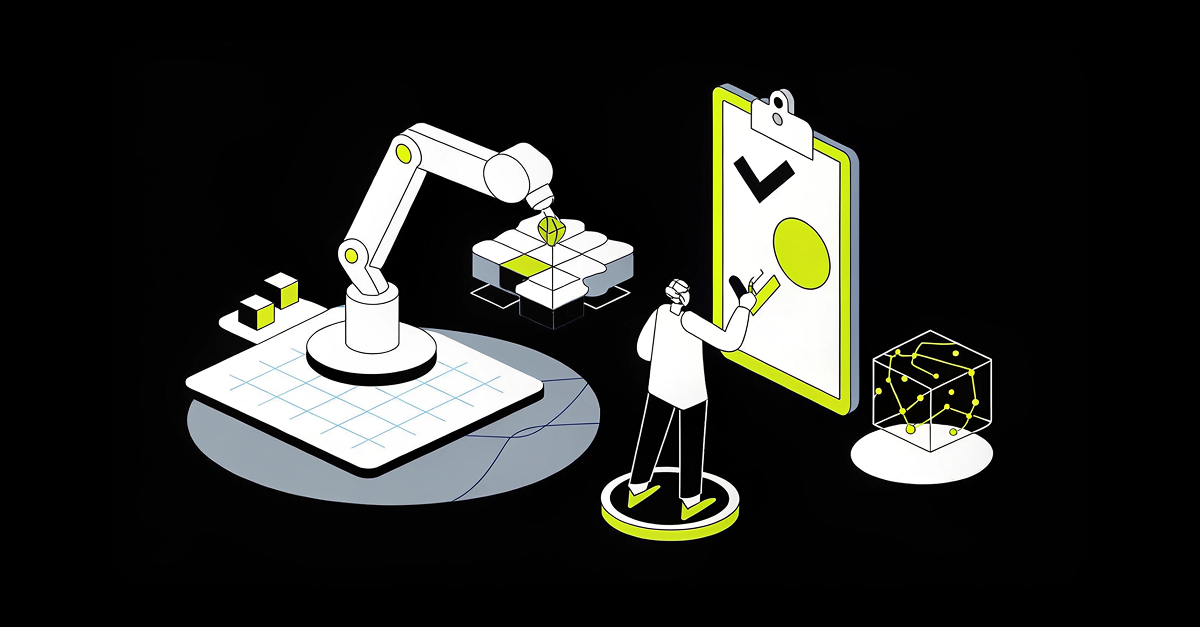

Claims automation

Use AI to classify, summarize, and route claims documents and images in real time.

![]()

Fraud detection and risk modeling

Train and deploy advanced models that detect fraud patterns and assess risk dynamically.

![]()

AI-powered customer service

Build voice or chat agents that resolve common policy, billing, and claims inquiries around the clock.

![]()

Policy personalization

Use predictive modeling to tailor recommendations and optimize pricing for individual policyholders.

![]()

Document processing and intake

Extract structured data from complex forms, including FNOLs, medical records, and policy documents.

![]()

Agent enablement and quote assistance

Give agents real-time AI support to surface policy details, generate quotes faster, and answer complex customer questions behind one pane of glass.

SUCCESS STORY

How Ping established ML-based leadership in commercial property insurance

Ping, a leading claims automation provider, needed a secure and flexible platform to power its AI pipeline. With Cake, they were able to deploy a production-grade intake engine in days, not months, while maintaining full control over their models, data, and cloud environment.

BLOG

5 insurance use cases where AI is changing the game

Explore the top use cases for AI in insurance, from risk assessment to fraud detection, and learn how these innovations can transform your business operations.

SECURITY & COMPLIANCE

Cake’s security commitment: SOC 2 Type II with HIPAA/HITECH certification

Cake’s AI infrastructure platform is SOC 2 Type II-audited and HIPAA/HITECH-compliant, providing the security, privacy, and regulatory readiness for modern insurance teams.

"Our partnership with Cake has been a clear strategic choice – we're achieving the impact of two to three technical hires with the equivalent investment of half an FTE."

Scott Stafford

Chief Enterprise Architect at Ping

"With Cake we are conservatively saving at least half a million dollars purely on headcount."

CEO

InsureTech Company

Frequently asked questions

What types of insurance companies does Cake support?

Cake supports carriers, MGAs, TPAs, and insurtechs across life, health, P&C, and specialty lines.

Can Cake help us stay HIPAA-compliant?

Yes. Cake is built with healthcare-grade security in mind, with tooling and controls to support HIPAA, SOC 2, and other frameworks.

Why does SOC 2 Type II matter for insurance workloads?

SOC 2 Type II audits verify that security, availability, confidentiality, and processing integrity controls are not only well‑designed but operate effectively over time, delivering stronger assurances for sensitive insurance data.

Do we need to rebuild our existing systems to adopt Cake?

No. Cake integrates with your current data, infra, and API landscape. You can adopt it incrementally.

What if we want to use private or fine-tuned models?

Cake supports private model training, evaluation, and deployment in your own cloud or VPC, including secure use of frontier and fine-tuned models.

How quickly can we get started?

Teams often start piloting Cake-backed use cases in days, with full production rollouts in weeks, not months.

Learn more about insurance built with Cake

What Are AI Steroids? A Guide to Faster AI Projects

See how “DevOps on steroids” and ai steroids are transforming insurtech AI, helping small teams launch faster and save on costs with smart automation.

A Practical Guide to Open Source Insurance

Find the best open source insurance tools for building AI solutions. Learn how to customize, integrate, and scale your insurance technology stack...

How Ping Data Intelligence Tames Unstructured Data

See how Ping Data Intelligence uses ML to streamline commercial property insurance, cut costs, and deliver faster, more accurate data for...

.png?width=220&height=168&name=Group%2010%20(1).png)